According to a recent article by CoStar, the U.S. retail real estate delivered another year of resilience in 2025, supported by a generally balanced relationship between supply and demand. This stability persisted even as the sector absorbed the impact of elevated store closings, underscoring the durability of well-located retail and the ongoing reset of weaker assets.

Beneath the headline performance, results varied sharply by market. In fact, market-by-market divergence reached its widest point since the pandemic, as store closures affected regions unevenly and demographic trends increasingly separated high-growth metros from slower-moving peers. The gap between outperformers and laggards continued to widen as a result.

Sun Belt markets once again dominated the national rankings, benefiting from population growth and business-friendly environments. Charlotte emerged as the top-performing retail market in the country, bolstered by its unique position spanning North and South Carolina and its ability to capture both demographic and economic momentum.

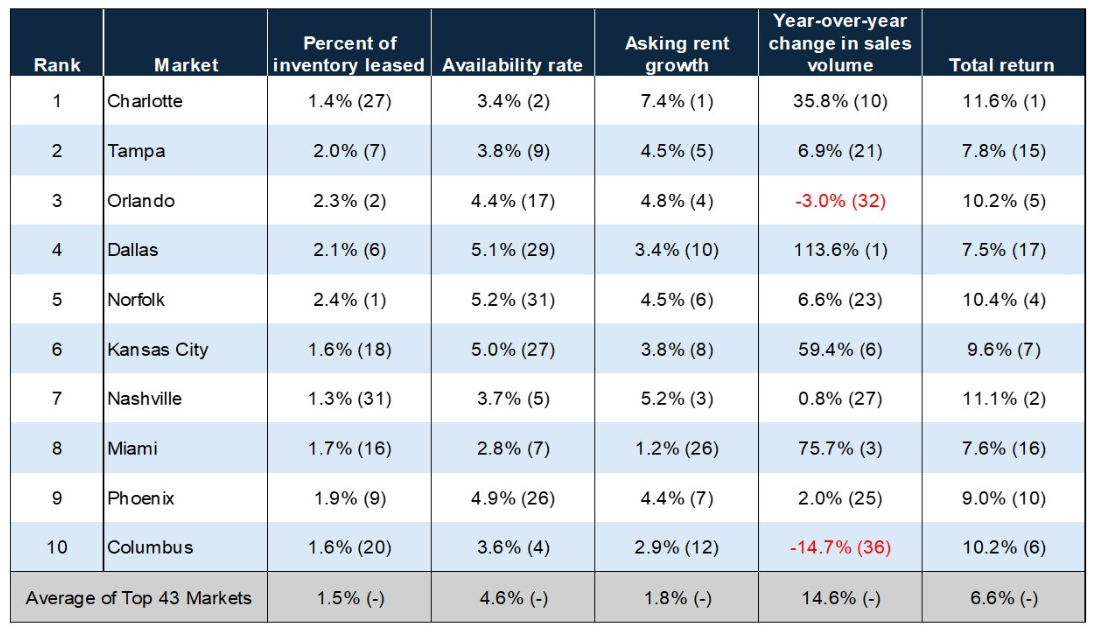

The rankings were determined using five equally weighted metrics: percent of inventory leased, availability rate, market rent growth, change in sales volume, and total return for retail properties based on CoStar’s market price index. Together, these indicators reflect occupancy conditions, pricing power, transaction velocity, and investment performance. When combined, the top five markets for 2025 were Charlotte, Tampa, Orlando, Norfolk, and Dallas, reinforcing the strength of the Southeast and Southwest. Charlotte’s rise to the top was driven by demographic tailwinds, a diversified employment base, and a disciplined approach to new supply.

Charlotte added more than 215,000 residents between 2020 and 2024, while white-collar job growth in 2025 exceeded national trends. That growth fueled extensive suburban housing development and sustained demand for neighborhood retail. Newly built grocery-anchored centers attracted expanding fitness concepts, discount retailers, grocers, and home-related brands.

Late-year retailer bankruptcies created short-term negative absorption, but demand for high-quality space remained strong. Well-located big box vacancies were quickly backfilled by expanding tenants, pushing Charlotte to the strongest rent growth of any major U.S. retail market in 2025 at an annualized average of 7.4%. Over the past decade, local retail rents have increased nearly 57%, compared with a national average of 34%, and average asking rents reached $26.25 per square foot in the third quarter, surpassing the national average for the first time on record.

Elsewhere, the broader top 10 reflected a mix of established growth markets and emerging contenders. Tampa and Orlando continued to benefit from population inflows and tight space availability, while Dallas leveraged its scale and transaction activity to secure a top-five ranking. Norfolk surprised with strong leasing momentum and renewed investor interest, Kansas City climbed on the strength of improved returns, and Nashville and Miami reaffirmed their status as high-demand Sun Belt markets. Phoenix remained a consistent performer, while Columbus stood out as one of the Midwest’s few bright spots.

Looking ahead to 2026, CoStar points out that the Southeast and Southwest appear to be in a good position to continue their steady retail performance. While rent growth may moderate and limited for-sale inventory could influence capital flows, market-level fundamentals remain sound. With restrained development pipelines and resilient consumer demand, retail real estate performance is expected to remain steady across leading markets.